Back to Guides

The Comprehensive Playbook for Starting (and Running) a Syndicate

The Comprehensive Playbook for Starting (and Running) a Syndicate

Welcome to Sydecar’s essential guide for starting and running a syndicate. Whether you're just getting started or you’re an experienced syndicate lead looking to refine your approach, this guide is designed to help you navigate every step of the process. We’ll cover everything from developing your brand and setting up your syndicate to closing your investment and managing distributions.

Syndicates have become a powerful tool for pooling capital and making strategic investments, offering flexibility for both syndicate leads and investors. With the right structure and approach, syndicates can be an effective way to back high-potential companies while maintaining control over the deals you want to pursue.

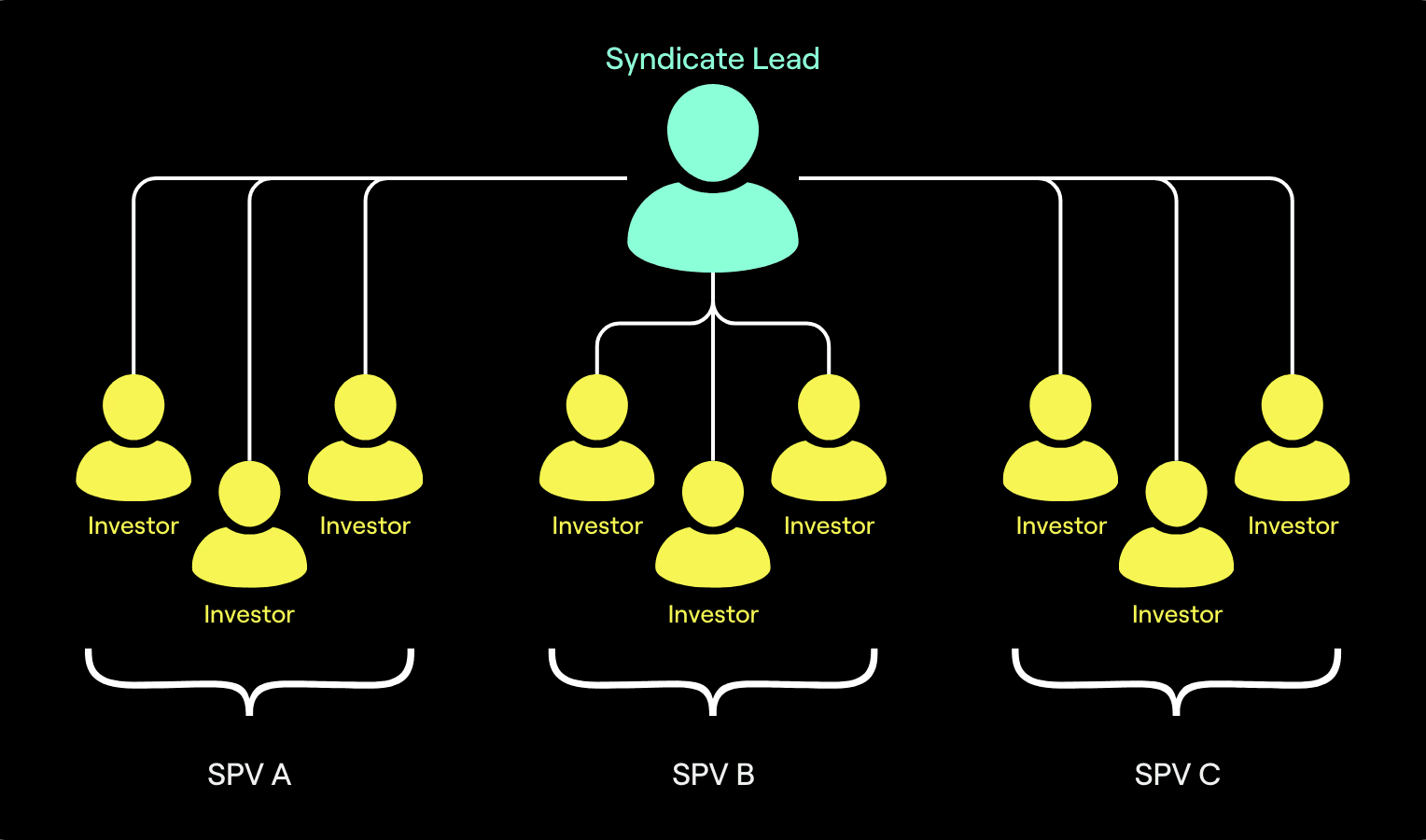

What is a Syndicate?

A syndicate operates like a venture capital firm, but instead of managing a blind pool of individual capital, capital is raised for each deal (or company) individually. These deals are led by an organizer (or group of organizers)--referred to as a “syndicate lead”--who is responsible for making investment decisions, performing due diligence, fundraising, and portfolio support. Syndicate leads are compensated through carried interest (though sometimes they may also charge a management fee), which is a share of the profits from successful investments. The standard carry rate is around 20%, though it can vary from deal to deal. Syndicates allow individual investors to participate in venture deals without committing to the long-term structure of a traditional fund, offering flexibility and the potential for high returns. Each transaction, or “syndicate deal”, is structured as a legal entity called a Special Purpose Vehicle (SPV).

Why Launch a Syndicate?

Syndicates have a wide array of unique advantages. The structure allows syndicate leads to not only invest more capital per deal but also access startups with high minimum commitments—investments they might not be able to pursue alone.

Starting a syndicate can serve as a stepping stone to launching a committed capital fund or as a way to break into the venture capital industry, even if you don’t have prior experience. Running a syndicate gives you invaluable experience in picking companies, managing investor relationships, and structuring deals. It also allows you to build a network of potential investors and hone your investment thesis, all while proving your ability to raise capital and execute on opportunities. Syndicates are particularly effective for those looking to invest in specific verticals, collaborate with industry peers, or establish credibility in the startup ecosystem.

Running a syndicate involves taking on deal logistics and managing investor relationships, but it’s a rewarding experience for those with the vision and drive to lead their own investments. With the right approach and tools, like Sydecar's platform, you can streamline these tasks and focus on growing your syndicate while maintaining full control over the process.

Steps for Starting and Running a Syndicate

1. Back Other Syndicates & Participate in Deals

Experienced syndicate leads Alex Pattis and Zach Ginsburg recommend that you start by becoming a member of existing syndicates to gain insights into the process, deal memos, and best practices. This will help you understand how syndicates operate, the types of deals that work best, and how to communicate effectively with investors.

2. Develop Your Brand & Investment Thesis

Before launching your syndicate, it’s important to establish your brand and communicate a compelling investment thesis. A refined thesis will help you clearly articulate why you’re investing in each deal, and sharing your background and expertise will build credibility with potential investors and help them understand what makes your syndicate unique. This will help you to attract investorsand set the foundation for long-term success.

3. Build Your Investor Base

Building a strong investor base starts with leveraging your existing network—reach out to colleagues, mentors, and professionals who share your investment interests. Hosting small events or virtual meetings to present your investment ideas can help establish trust. Co-investing with established GPs or joining other syndicates is another way to expand your network and gain visibility with potential investors. Regular, transparent communication about deal progress and performance will keep your investors engaged and ready for future opportunities.

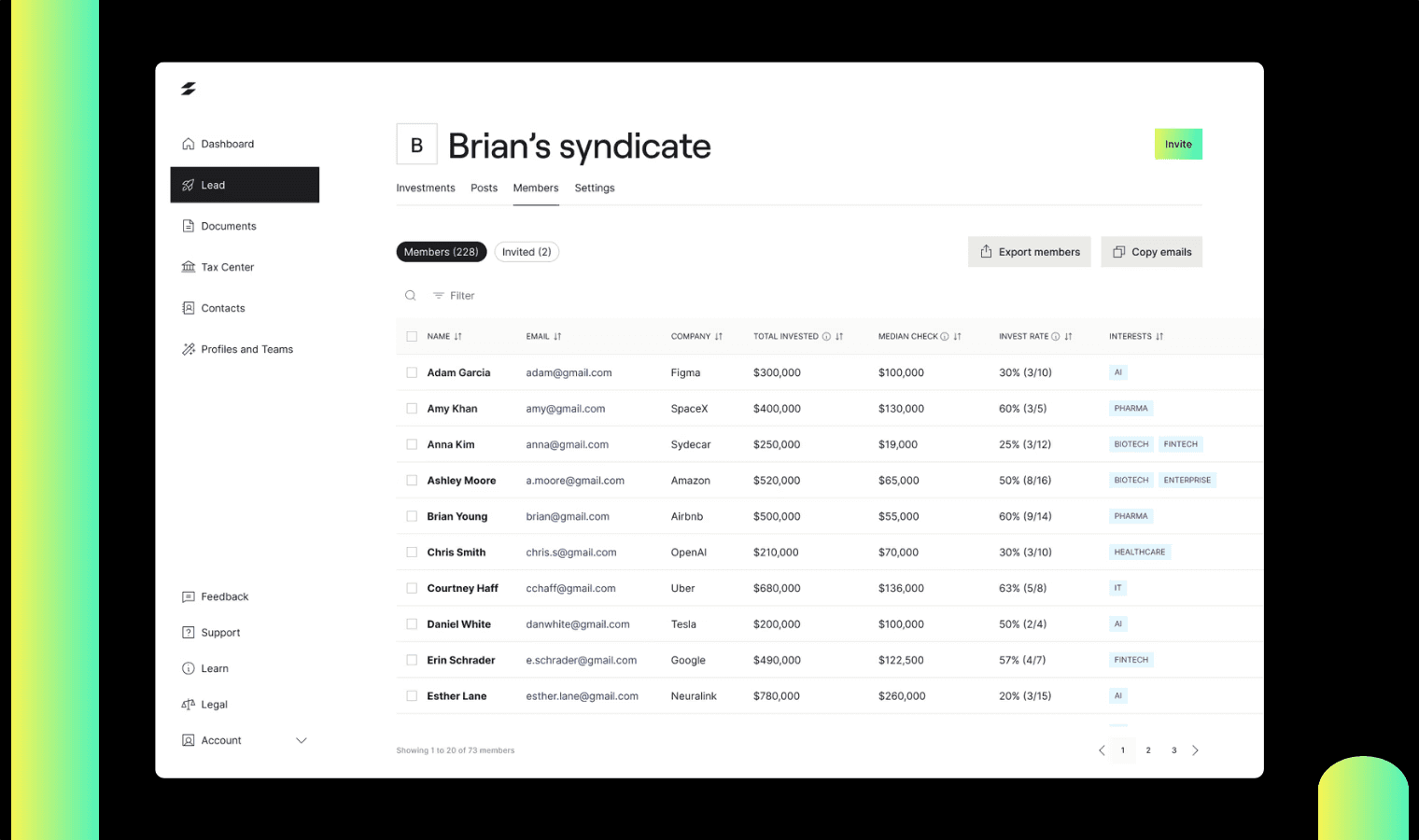

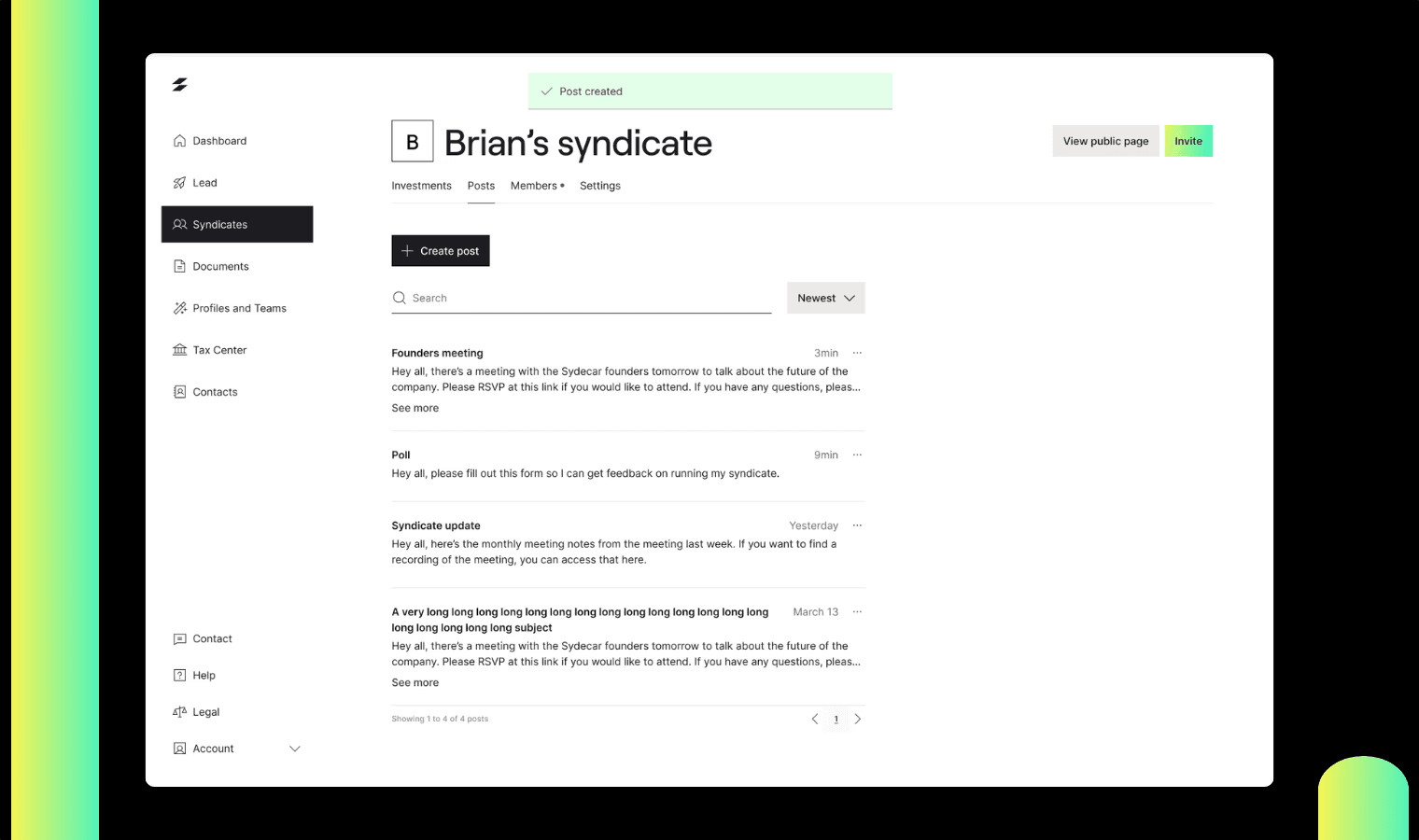

4. Setup Your Syndicate

Once you’ve built a solid investor base, it’s time to officially launch your syndicate. Setting up a syndicate on Sydecar’s platform is straightforward and efficient. With just a few clicks, you can create a new syndicate and invite your investors to participate directly through the platform. Once your syndicate is live, investors can view and opt into deals through a private portal, ensuring a smooth and transparent investment process. Sydecar's deal-tracking functionality provides insights into investor participation, allowing you to easily track engagement, target active investors, and make data-driven decisions for future opportunities.

Get analytics on investor participation with Sydecar's deal-tracking functionality.

5. Establish Deal Flow

Building a consistent deal flow is crucial to the success of your syndicate. As the lead, your goal is to identify and curate a steady stream of high-quality investment opportunities that align with your investment thesis. This means actively networking, sourcing deals, and maintaining relationships with founders, venture capitalists, and other syndicate leads. By focusing on strong opportunities with reputable co-investors, solid market traction, and experienced founding teams, you’ll establish credibility with your investors and build momentum for your syndicate. Over time, consistently delivering quality deals will strengthen your reputation and make it easier to attract investors to future opportunities.

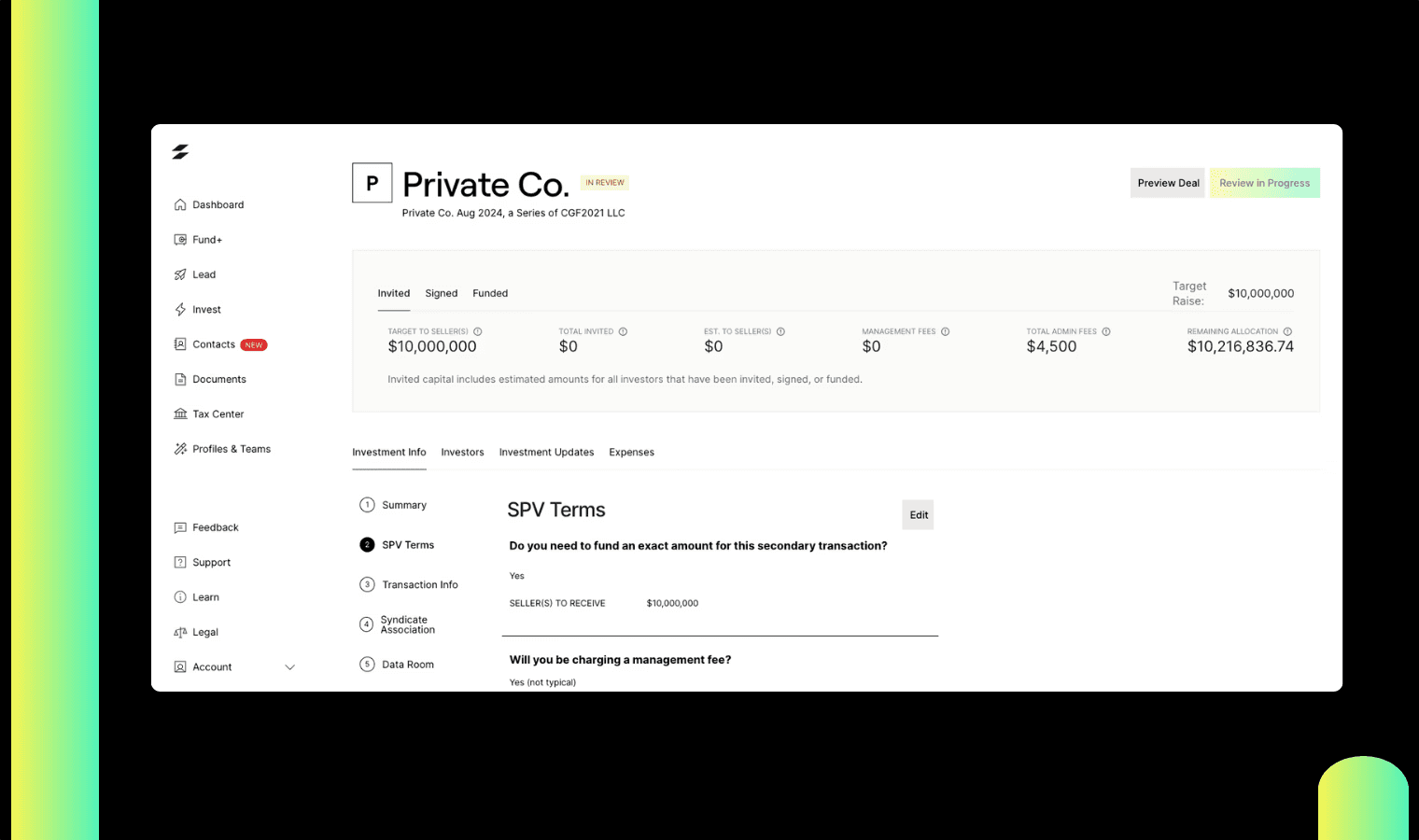

6. Launch an SPV

When you’re ready to move forward with a deal, the next step is to launch an SPV to pool capital from your investors. Timing is key—ensure you've gauged interest from your investors and have strong commitments before setting up the SPV. Sydecar’s platform makes this process seamless by handling the legal setup, compliance, and banking, allowing you to focus on securing investor participation. Once the SPV is ready, you can quickly share the opportunity with your syndicate and manage securing the allocations directly within the platform.

Seamlessly set up an SPV for your syndicate on Sydecar's platform.

7. Manage Investor Interest

Once you’ve opened a deal to your syndicate, interested investors may request additional information, such as financial data, milestones achieved, or market analysis. With Sydecar, you can easily share deal memos, updates, and documents directly within the platform, keeping all communication in one place. As the lead, you’ll guide potential investors through their decision-making process, answering questions and providing the details they need to feel confident in their commitment.

Easily share documents and data with your investors through Sydecar's member portal.

8. Close & Monitor the Investment

Once all funds are secured, you will close the deal. Sydecar ensures the smooth transfer of capital, and the investment is made. After the investment is made, you should establish clear expectations with the founders for regular updates and timelines. This could include monthly or quarterly check-ins to track key milestones like revenue targets, product launches, or customer growth. Using Sydecar’s platform, you can easily relay these updates to your investors. Whether it's sharing milestone achievements, financial updates, or investor reports, Sydecar’s built-in communication tools allow you to centralize everything in one place. This gives your investors full visibility into the startup’s progress and ensures you can quickly respond to questions or concerns about the investment.

9. Manage Distributions

When your investment reaches a liquidity event, returns are typically distributed either as cash or in-kind equity. Cash distributions are straightforward, with profits transferred back to investors after fees and carry, while in-kind equity involves transferring shares from the startup or acquiring company. Sydecar’s platform simplifies both processes, automating cash disbursements and assisting with in-kind equity distributions. Clear communication is key—use the platform to set expectations with investors and founders, tracking timelines and providing updates on potential delays or changes.

As you gain experience and build a track record, scaling your syndicate becomes the next logical step. Expanding your investor base, increasing deal flow, and managing more complex transactions can all be part of your syndicate’s growth. Sydecar’s Syndicate platform is designed to support you at every stage of that journey, offering streamlined tools to help you manage investor communications, track participation, and simplify administrative tasks. Visit our Syndicate page to learn more about how our product can help you streamline your operations and scale your syndicate:

See How Sydecar Works in <2 Minutes

Explore our interactive demo to see how simple it is to launch and manage your next SPV.

Disclaimer: This content is made available for general information purposes only, and your access or use of the content does not create an attorney-client relationship between you or your organization and Sydecar, Inc. (“Company”). By accessing this content, you agree that the information provided does not constitute legal or other professional advice, including but not limited to: investment advice, tax advice, accounting advice, legal advice or legal services of any kind. This content is not a substitute for obtaining legal advice from a qualified attorney licensed in your jurisdiction and you should not act or refrain from acting based on this content. This content may be changed without notice. It is not guaranteed to be complete, correct or up to date, and it may not reflect the most current legal developments. Prior results do not guarantee a similar outcome. Please see here for our full Terms of Service.

Solutions

Legal

Referral Program Agreement

Stay in touch

Subscribe to our newsletter

© 2025 Sydecar, Inc.