Company & Product Updates

Sydecar Fund+: Fund Administration for the Next Generation of VCs

At a Glance

Fund+ is Sydecar’s end-to-end fund formation and administration platform, purpose-built for emerging managers launching funds under $10M.

It offers standardized legal docs, automated compliance workflows, and mobile-friendly subscription agreements so managers can launch in days, not months.

Managers remain in control of their fund while Sydecar handles the back office, including banking, capital calls, tax reporting, and regulatory filings.

Unlike traditional fund administrators that charge high upfront fees, Fund+ offers a modern pricing model that scales with your fund size.

Fund+ supports hybrid strategies as well, allowing committed capital funds to seamlessly invite outside co-investors while maintaining a single cap table line.

Today, we’re excited to launch a new product that will empower emerging venture capitalists, syndicates, angel groups, and investor communities to spin up venture funds in a fraction of the time (and at a fraction of the cost). Sydecar's Fund+ was built for venture investors who want to put their capital to work supporting world-changing startups, not paying for exorbitant fund administration fees.

Launching a venture fund has historically been expensive, complex, and time consuming. The costs and time involved with fund formation leaves capital allocators with two options: raise tens of millions of dollars to justify fees, or pay for fund expenses out of pocket. For most, both options are out of reach.

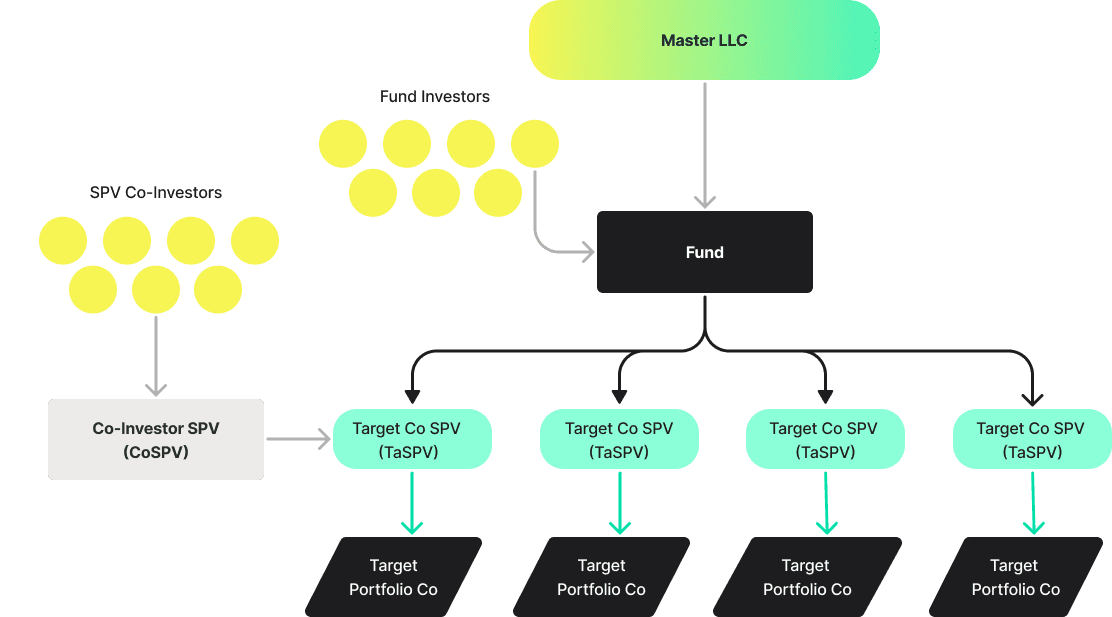

Sydecar's Fund+ provides a third option: end-to-end fund formation and administration with reasonable fees that scale with fund size. Our standards-driven approach allows emerging fund managers to get into business quickly without forking over $50k+ to draft legal documents from scratch. Our structure, illustrated below, combines the stability of a committed capital fund with the flexibility of deal by deal investing so that fund managers never have to turn away capital. Sydecar's Fund+ offers automated banking, compliance, contracts, tax, and reporting, all built on our proprietary general ledger software.

“Sydecar’s Fund structure allowed me to go all in on venture investing. I’ve been angel investing and running a syndicate for several years, but I never imagined being able to do this full time because of how expensive and time consuming running a fund typically is. Because of Sydecar's product-driven approach, I’ve been able to scale to a $10M fund in just a few months without the headache that comes with traditional fund admins.” - Nik Milanovic, GP of The Fintech Fund

After a decade-long bull market, the recent downturn presents a huge opportunity for anyone deploying reasonable amounts of capital into early stage companies. While many institutional VCs appear “closed for business,” emerging fund managers, syndicates, and operator-investors are eager to back the exciting companies forming during this time. Sydecar’s approach enables these new stakeholders, making it possible to raise micro-funds as small as $1M.

“We are launching Fund+ at a pivotal moment in venture capital,” says Founder & CEO Nik Talreja. “As the bull market gives way to a downturn, traditional models for supporting capital allocators - from marketplaces to manual service providers - start to break down. The industry’s focus on short term growth has led to a proliferation of bespoke structures and custom legal agreements that require the support of lawyers, fund accountants, and tax advisors. All of this is costly and unscalable.”

We developed the Fund+ structure to fit the unique needs of emerging venture fund managers. Our standardized legal documents limit the need for lengthy negotiations with investors. Emerging fund managers can get started raising capital in just a few days, so that they can get back to what they do best: building relationships and backing amazing companies. Our documents are informed by months of research into industry standard terms that provide appropriate protections to both fund managers and their investors.

The Fund+ structure allows managers to:

Launch a fund and accept capital commitments in less than a week.

Offer customized terms and economics for each investor depending on your unique relationship.

Streamline investor onboarding with mobile-friendly subscription agreements and fund and compliance documents.

Invite third-party investors to an opportunity while maintaining a single line on a company’s cap table.

Remain in full control of your fund by leveraging a self-managed entity, while Sydecar acts solely as the administrator, taking direction directly from the manager.

Avoid paying expensive service providers for fund formation, regulatory filings, tax, accounting, and reporting.

“Sydecar gives us real time visibility into all of our capital commitments and capital call schedules. We love having a document center where every single deal and every single document is easily accessible. We’ve spent significantly less time managing spreadsheets and email threads as compared to our previous fundraises.” - Gary Raju, CFO of Prota Ventures

We’re excited to be growing with the next generation of venture investors who have already embraced our standards-driven approach to SPVs. With this launch, we are furthering our mission of bringing more efficiency, transparency, and liquidity to the private markets. Our journey to transform the way private markets operate is just beginning, and we’re grateful for all that choose to embark on it with us.

“We wanted to work with smart people who would push the envelope a little bit on approaching things from a different angle, especially since we're navigating this entire journey as first time fund managers.” - Daniel Ha, GP of Antigravity Capital

Keep Reading

See How Sydecar Works in Under 2 Minutes

Explore our interactive demo to see how simple it is to launch and manage your next SPV.

Disclaimer: This content is made available for general information purposes only, and your access or use of the content does not create an attorney-client relationship between you or your organization and Sydecar, Inc. (“Company”). By accessing this content, you agree that the information provided does not constitute legal or other professional advice, including but not limited to: investment advice, tax advice, accounting advice, legal advice or legal services of any kind. This content is not a substitute for obtaining legal advice from a qualified attorney licensed in your jurisdiction and you should not act or refrain from acting based on this content. This content may be changed without notice. It is not guaranteed to be complete, correct or up to date, and it may not reflect the most current legal developments. Prior results do not guarantee a similar outcome. Please see here for our full Terms of Service.

Solutions

Legal

Referral Program Agreement

Stay in touch

Subscribe to our newsletter

© 2025 Sydecar, Inc.